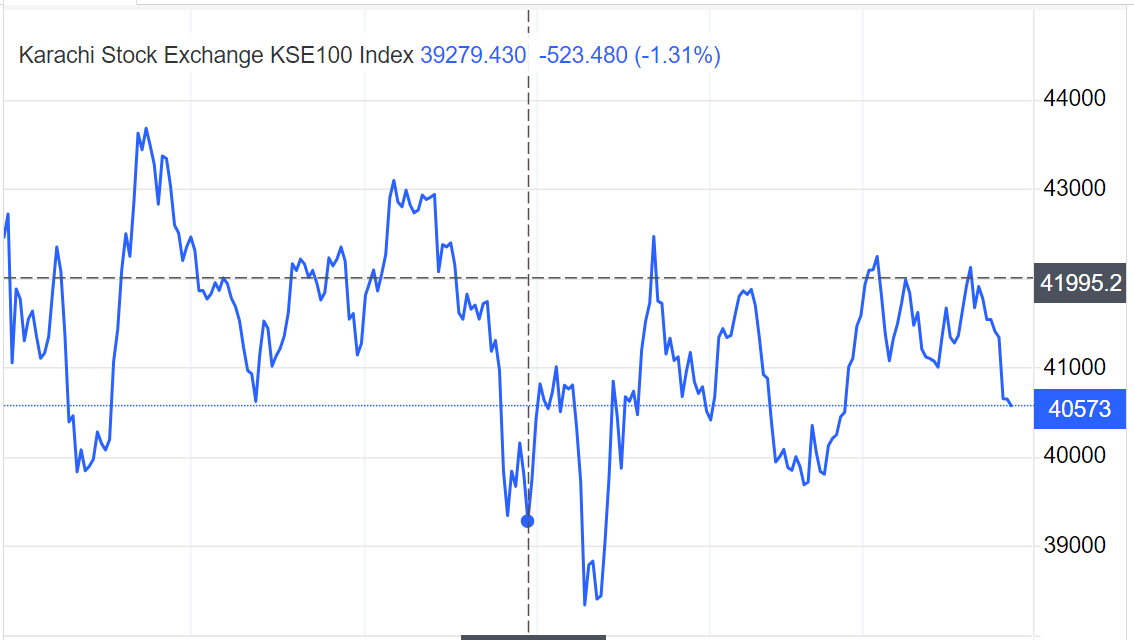

The benchmark KSE-100 index closed 0.3% lower at 40,700 points on Thursday as investors booked profits after a recent rally.

The index had gained more than 2% in the previous two sessions but reversed those gains on Thursday.

Investors were selling stocks across the board, with all market sectors in the red.

Banking, fertilizer, and oil and gas were the most heavily traded sectors.

The selling pressure was likely due to a combination of factors, including concerns about the global economic outlook and profit-taking after the recent rally.

The KSE-100 index is still up more than 10% year-to-date but has been volatile recently.

Investors will likely remain cautious in the near term as they await more clarity on the global economic outlook.

Here are some of the factors that could impact the stock market in Pakistan in the near term:

- The global economic outlook: The global economy faces several headwinds, including rising inflation, interest rates, and the war in Ukraine. This could weigh on the demand for Pakistani exports and lead to a slowdown in economic growth.

- The political situation in Pakistan: The political situation in Pakistan is also uncertain. The government faces challenges, including a brewing economic crisis and rising political instability. This could also lead to a sell-off in the stock market.

- The interest rate outlook: The State Bank of Pakistan is expected to raise interest rates in the coming months to control inflation. This could also weigh on the stock market. With rising interest rates, businesses are finding it increasingly costly to obtain loans. And invest.

Overall, the outlook for the stock market in Pakistan in the near term is uncertain. Understandably, investors may feel hesitant in this current climate as they navigate the ever-changing economic landscape. Await more clarity on Pakistan’s global economic outlook and political situation.